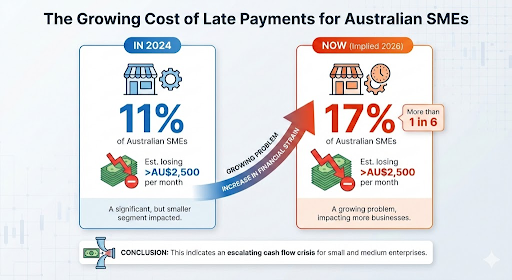

- More than 1 in 6 Australian small and medium businesses (17%) estimate losing over AU$2,500 per month due to late payments, which is up from 11% in 2024. This indicates a growing problem for SME cash flow.

- On average, Australian SMEs are paid about 6.4 days later than agreed payment terms, costing small business owners an estimated AU$1.1 billion in lost working capital each year.

Unpaid invoices and late payments are common challenges for small and medium enterprises. Even a few overdue accounts can put pressure on daily operations, staff payments, and future planning. When money that is rightfully earned does not come in on time, businesses may struggle to manage expenses or invest in growth opportunities. This is where a commercial debt collection agency plays a crucial role.

This is where a No Recovery-No Fee debt collection model becomes a practical option. It allows businesses to seek professional help without taking on additional financial risk. In this blog, you will learn what this model means, how it works, and why it is especially beneficial for SMEs looking to protect cash flow and maintain business stability.

What Is a “No Recovery-No Fee” Debt Collection Model?

A No Recovery-No Fee debt collection model means that a business only pays a fee if the outstanding debt is successfully recovered. If no money is collected, there is no charge for the service. This approach is also known as a no win no fee or contingent fee model. It is usually offered by a commercial debt collection agency that specialises in recovering unpaid business debts.

Unlike traditional fee-based methods, where costs may apply upfront, this model focuses on results. For SMEs, this makes debt recovery more accessible and less risky. It also ensures that the commercial debt collection agency is motivated to recover the debt efficiently, as their payment depends on success.

Why SMEs Benefit from the No Recovery-No Fee Model?

Minimised Financial Risk

One of the biggest advantages for SMEs is the reduction in financial risk. With a No Recovery-No Fee debt collection approach, businesses do not need to pay upfront fees or ongoing charges. This is especially important for smaller businesses that need to manage expenses carefully. The risk is largely shifted to the money recovery agency, as they invest their time and resources into recovering the debt.

SMEs only incur a cost when there is a positive outcome. This improves financial predictability and allows business owners to seek help without worrying about wasted spending if recovery is unsuccessful.

Improves Cash Flow and Liquidity

Healthy cash flow is essential for the smooth running of any SME. Recovering overdue payments helps businesses meet their financial commitments, such as rent, wages, and supplier invoices. Timely payments also allow owners to plan ahead and reinvest in growth. Professional debt recovery agents often focus on serious debtors and use proven methods to encourage faster payments.

This can significantly improve SME debt recovery outcomes. By improving business cash flow, SMEs can reduce stress and focus more on delivering products or services rather than chasing unpaid invoices.

Saves Time and Resources

Chasing overdue accounts can take up a lot of time, especially when internal staff are not trained in debt recovery. Repeated follow-ups, phone calls, and emails can distract employees from their main responsibilities. Outsourcing this task to a national debt collection agency allows staff to focus on core SME operations such as sales, customer service, and growth planning.

Professional agencies follow structured processes and regular follow-ups, which improve efficiency. This not only saves time but also reduces internal frustration and workload pressure.

Access to Expertise and Advanced Tools

A commercial debt collection agency brings experience, negotiation skills, and specialised systems that most SMEs do not have in-house. Their teams understand how to communicate effectively with debtors while remaining professional and respectful. Many agencies also use advanced tracking and reporting tools to monitor progress and keep clients informed.

Providers such as National Collections focus on transparent processes and client-focused practices. This helps protect the reputation of SMEs while improving the chances of successful recovery.

Improved Customer Relationship Management

Professional Perth debt collectors are trained to handle sensitive conversations carefully. Their approach is firm but respectful, which can help preserve business relationships where possible. This is important for SMEs that may want to continue working with customers once payments are resolved.

By using professional communication methods, businesses can avoid emotional or unprofessional interactions that may damage future sales opportunities.

Cost-Effective Compared to Internal Hiring or Legal Action

Hiring dedicated staff for debt recovery or pursuing formal legal action can be expensive and time-consuming. For many SMEs, these options are not practical. A No Recovery No Fee model is often more predictable and affordable because costs only arise after a successful result. This makes it a suitable option for businesses looking for effective SME debt management without long-term financial commitments.

How to Choose the Right “No Recovery No Fee” Debt Collection Partner?

- Look for clear and transparent fee structures so you understand exactly when charges apply and avoid unexpected costs

- Choose debt collection agencies that follow ethical practices and comply with recognised industry standards to protect your business reputation

- Prioritise partners that offer clear communication and regular progress reporting, keeping you informed at every stage

- Ensure the debt collection partner aligns with your business values and handles customers professionally to support long-term relationships

National Collections Follows A No Recovery-No Fee Debt Collection Approach

A No Recovery-No Fee debt collection model offers clear benefits for SMEs, including reduced financial risk, improved cash flow, time savings, and access to professional expertise. By removing upfront costs, this approach makes professional debt recovery more accessible for small and medium businesses that need to manage budgets carefully.

National Collections applies this model with a strong focus on ethical recovery, transparent processes, and clear communication. The structured approach helps businesses in Perth and WA pursue overdue accounts without placing additional pressure on internal teams or cash flow.

By working with experienced debt recovery agents, business owners can spend more time focusing on growth and day-to-day operations while overdue invoices are handled professionally. For SMEs facing ongoing payment delays, reviewing your current debt recovery strategy and considering a No Recovery-No Fee approach with a trusted provider can be a practical step toward improving financial stability and maintaining long term business health.

FAQs

- What are the top 3 skills for a collection officer?

The top skills of debt recovery agents include strong communication skills to handle sensitive conversations, negotiation skills to reach payment solutions, and attention to detail to manage accounts accurately while adhering to ethical and compliance standards.

- How long does the debt collection process usually take?

There is no fixed timeline as each case varies in complexity. Some debts may be resolved quickly by debt recovery agents, while others take longer depending on debtor responsiveness and the actions needed to secure payment.