Late payments remain one of the biggest challenges for businesses across Australia, especially for small and medium enterprises. When invoices are not paid on time, cash flow becomes unpredictable, operational planning suffers, and businesses may eventually need support from debt recovery agents or a commercial debt collection agency.

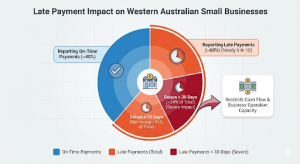

In Western Australia, nearly six in ten small businesses report late payments from their clients, with around 24% experiencing payment delays of more than 30 days, restricting cash flow and business operation capacity.

While professional recovery services play an important role, prevention is always better than a cure. Automated invoicing and payment reminders have emerged as practical, non-intrusive tools that help businesses reduce late payments, minimise outstanding debt, and maintain healthier customer relationships.

This blog explains how automation works, why it matters, and how it supports smoother accounts receivable management while reducing reliance on debt collections agencies.

Why Late Payments Are a Major Business Issue?

Late payments create serious challenges beyond lost revenue. When invoices remain unpaid, businesses struggle to manage payroll, pay suppliers, and plan for growth. Over time, repeated delays increase financial pressure and can lead to the need for national debt collection support.

In Western Australia, the issue is particularly significant. Around 6 out of 10 small businesses experience late payments, and nearly one in four face delays of more than 30 days, placing ongoing strain on cash flow and daily operations. Many of these delays are caused by avoidable issues such as manual invoicing errors, missed follow-ups, or customers simply forgetting to pay.

For businesses that later rely on Perth debt collection or debt collection in Mandurah, improving early payment behaviour is critical. Automated invoicing helps address these problems by ensuring accuracy, consistency, and timely payment reminders before debts escalate.

What Are Automated Invoicing and Payment Reminders?

Automated invoicing is the use of software systems to generate and send invoices automatically when a sale is completed or a billing cycle begins. These invoices are created using predefined templates, correct pricing, and clear payment terms, reducing the risk of human error.

Payment reminders are automated messages sent to customers before and after the invoice due date. These reminders can be scheduled at set intervals and delivered through email or SMS. Together, automated invoicing and reminders remove the need for manual follow-ups while ensuring customers are informed, prompted, and guided to pay on time. Many systems also integrate with accounting platforms, providing real-time visibility into outstanding balances and payment trends.

Key Benefits of Automated Invoicing and Payment Reminders

Speeds Up Payment Collection

One of the biggest advantages of automation is faster payment cycles. Automated reminders notify customers at the right time, reducing delays caused by forgotten invoices. When customers receive reminders before the due date, and shortly after, they are more likely to act quickly.

This reduces invoice ageing and lowers the risk of accounts becoming overdue long enough to require debt recovery agents. Businesses that use automated reminders often see a noticeable improvement in payment speed, as consistent communication creates better payment habits over time.

Improves Cash Flow and Reduces Commercial Debt

Timely payments lead directly to stronger cash flow. When invoices are paid as agreed, businesses can cover operating costs, manage supplier relationships, and plan growth with greater confidence. Automation helps prevent debts from accumulating by addressing delays early.

For many businesses, this means fewer situations where accounts escalate to debt collection in Mandurah or Perth debt collection services. By reducing long term and bad debt, automated invoicing acts as a first line of defence in commercial debt management.

Saves Time and Reduces Manual Errors

Manual invoicing is time-consuming and prone to mistakes such as incorrect amounts, missing details, or duplicate invoices. These errors often lead to disputes, delayed payments, and unnecessary back-and-forth with customers.

Automation eliminates these issues by standardising invoice creation and delivery. Staff no longer need to spend hours chasing payments or correcting errors, allowing them to focus on higher-value tasks. This efficiency also ensures cleaner records if accounts ever need to be reviewed by debt collection agencies.

Enhances Professionalism and Communication

Automated invoicing and reminders create a consistent and professional communication process. Customers receive clear, polite, and timely messages that reinforce payment expectations without damaging relationships.

Businesses can customise reminder tones and frequencies based on customer history, helping to maintain goodwill while still encouraging prompt payment. This professional approach reduces friction and often resolves payment delays before they become serious issues.

Tools and Features to Look For

When choosing an automated invoicing solution, businesses should focus on features that support both efficiency and visibility.

|

Feature |

Benefits |

|

Automated scheduled reminders |

Reduces forgotten payments |

|

Multi-channel notifications |

Reaches customers via email or SMS |

|

Real-time dashboards |

Tracks invoice status instantly |

|

Custom invoice templates |

Maintains brand consistency |

|

Accounting system integration |

Simplifies reconciliation |

The right tools not only reduce late payments but also provide data insights. Businesses can identify repeat late payers, adjust credit terms, and take early action before debts escalate.

How Automation Supports Commercial Collections and Debt Recovery?

Automated invoicing does not replace the need for a commercial debt collection agency, but it significantly reduces how often businesses need one. By improving early payment rates, fewer accounts reach the stage where external recovery is required.

When recovery support is needed, automation ensures records are accurate, communication history is documented, and follow-ups are clearly tracked. This makes the recovery process more efficient for both businesses and debt recovery agents, improving outcomes while saving time.

Conclusion

Automated invoicing and payment reminders play a vital role in reducing late payments, strengthening cash flow, and minimising commercial debt. By addressing common causes of overdue invoices early, businesses can lower their reliance on debt collections agencies and maintain better control over accounts receivable.

When prevention alone is not enough, working with a trusted provider such as National Collections ensures overdue accounts are handled professionally and ethically. Combining smart automation with experienced support allows businesses to protect cash flow, reduce financial stress, and focus on sustainable growth.

FAQs

What does a debt collection agency do?

A debt collection agency helps businesses recover unpaid invoices by contacting debtors in a structured and professional manner. A commercial debt collection agency or national debt collection service works to secure payments while allowing businesses to focus on operations instead of chasing overdue accounts.

Is it worth using a debt collection agency?

Yes, using debt recovery agents can be worthwhile when internal follow-ups fail. Professional debt collection agencies, including Perth debt collection and debt collection in Mandurah, improve recovery rates, save time, and reduce financial stress by handling overdue accounts efficiently and professionally.

Why is it beneficial to automate your debt payments?

Automating invoicing and payment reminders helps reduce late payments by ensuring invoices are accurate and reminders are sent on time. This proactive approach improves cash flow, reduces the need to engage debt recovery agents, and lowers the likelihood of accounts being escalated to national debt collection services.